Ghanaian banks will benefit from the end of the domestic debt exchange programme (DDEP) and restored capital buffers, Fitch Solutions has disclosed.

However, a high Non-Performing Loans of 9.5% in October 2025 will constrain profitability going forward.

In its article “Sub-Saharan Africa Banking Key Themes For 2026: Banks Navigate Easing Cycles And Consolidation Trends”, the UK-based firm said it expects more accommodative monetary policy, but anticipates loan growth to accelerate for most markets in 2026.

“We forecast loan growth will accelerate across SSA’s largest banking sectors and the region will experience the strongest growth rate by year-end. This acceleration reflects pent-up demand, improving economic growth prospects and a reduction in government crowding out as fiscal consolidation efforts ramp up and sovereigns look for alternative sources of financing”.

In recent years, many SSA banking sectors have increased their holdings of government securities, attracted by high yields. In some markets, government securities now represent 20-35% of bank assets, up from 10-15% pre-pandemic.

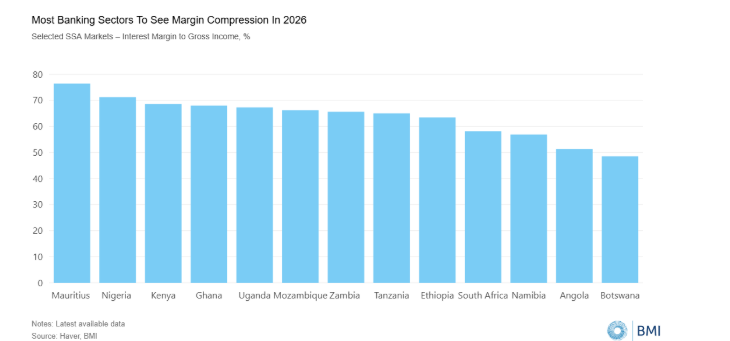

As policy rates fall and securities yields compress, Fitch Solutions said banks will face pressure to redeploy capital into private-sector lending to maintain returns. “This transition will be positive for businesses and the economy as more credit becomes available to support growth initiatives”.

It added that this shift will be particularly pronounced in markets where governments are pursuing fiscal consolidation, reducing domestic borrowing requirements.

The monetary policy landscape across SSA’s major banking sectors is shifting decisively toward easing. Since February 2025, central banks in the largest SSA markets have either cut policy rates or held them steady following earlier cuts and we expect this trend to continue through 2026.